| home > Introduction |

|

| III. Key Legal, Tax and Accounting Considerations in Real Estate Securitization | |||

1. Legal Considerations 1) Bankruptcy Remoteness: Concept and Structural Necessity Securitization transfers the securitized asset from the originator and places it in a securitization vehicle which has a capital structure created based on the cash flows that the asset can generate. In principle the securitization is not dependent on the creditworthiness of the originator and so investors demand that any direct impact on the investors from bankruptcies of the originator or the vehicle itself be eliminated, this is referred to as being bankruptcy remote. Bankruptcy remoteness is essential in an asset monetization securitization, which requires the stability of the securitization vehicle. The steps taken to ensure bankruptcy remoteness would include. a. Legally separating the securitized asset from any influence of the bankruptcy of the originator; and b. Minimizing the bankruptcy risk of the actual vehicle owning the asset subject to securitization (Tokutei Mokuteki Kaisha (TMKs) under the Asset Monetization Law, SPCs with the form of KKs and YKs, etc.). 2) Separation from Originators For this situation to occur the custodian appointed on bankruptcy of the originator would judge that the transfer of the asset was not a true sale (see 4) True Sale), but that it was the provision of collateral and thus deny the original transfer of the asset to the securitization vehicle. If this were to occur the collection of investment funds is only possible through reorganization collateral rights in relation to the corporate reorganization of the originator. The following are considered when judging the bankruptcy remoteness of a securitization vehicle from its originator. a. Rational intent of the interested parties as indicated by the contract. b. Third party involvement in the securitization process c. Appropriateness of the transfer price d. Is the risk of the transaction appropriately assigned? e. Is the transaction merely for accounting purposes? f. Is the securitization vehicle independent? (Eliminate all aspects of control the originator may have over the securitization vehicle) The last item on this list requires some technical aspects to be addressed and to achieve a bankruptcy remote structure Cayman SPCs with charitable trusts or Chukan Hojin are regularly utilized. 3) Minimizing the Risk of the Securitization Vehicle going Bankrupt However, the legal validity of these preventative measures have not been tested in the courts so cannot be 100% relied on yet. 4) True Sale The judgment of whether a transaction is a collateral movement or a true sale is a legal judgment and can in practice lead to problems in the event of a bankruptcy therefore specific steps are taken that includes clearly stipulating the desire to sell and buy the asset to be securitized in the sales and purchase agreement and obtaining a legal opinion that quantifies the risk being borne by the originator after the transfer of the asset as well as that fair consideration was paid for the asset among other aspects. When the 5% accounting rule prevents an asset from being moved off a balance sheet for accounting purposes there are many instances where a true sale is demonstrated through a legal opinion and adding an annotation to the balance sheet in which the asset is consolidated that the sale of the asset has been completed, however there remains a difference of opinion in the market over the validity of this process. 5) Defenses Against Third Party Claims To provide sufficient defense against third party claims in the ordinary transfer of assets requires a notice to be issued or the approval of the debtor that the asset being transferred is released from any claim and such approval should be provided in writing. Designated monetary claims of corporations can have third party claims mitigated without the approval of the debtor by registering the credit transfer in the registry, this is a result of the “Law on the Exception to the Civil Code concerning Requirements Set Up Against the Transfer of Claims” (Special Credit Transfer Law) issued in conjunction with the SPC Law in 1998. As it is impossible to meet the requirements against the debtor it is normally necessary to issue notices or complete other procedures to prevent the creditor from exercising any rights with regard to set off when the originator and debts were related in some fashion and where the creditor has rights of offset payments. 6) Bankruptcy of Servicers The most common methods for mitigating commingling risk are using separate dedicated accounts for the management of collected funds for third parties, reducing the period of time the servicer actually holds the funds in its accounts to a minimum and enhancing the credit of the servicer through posting of cash collateral, the use of bank guarantees, etc. There have been cases where back-up servicers have been used to recover funds in place of the original servicer when the original servicer is unable to perform these duties for some reason. 7) Bankruptcy Remote Vehicles - Analysis by Governing Law a. Asset Monetization Law Among the methods for preventing the arbitrary termination of directors in the general meeting of the members of a TMK are limiting the legal voting rights of preferred equity members and/or using the articles of incorporation to prevent proposals by members to terminate directors. (2) Special Purpose Trusts (SPTs) b. Investment Trust Law (2) Investment Trusts c. Real Estate Syndication Act (TKs) 8) Bankruptcy Remote Structures a. Specific Interest Trust Use of a specific interest trust eliminates all influence of the originator of the TMK over the TMK and achieves the same as a Cayman SPC and charitable trusts. However there are still very few instances where the specific interest trust has been used because of doubts over the validity of the law that prevents the termination of the trust during the trust period. b. Cayman SPC & Charitable Trust used in

conjunction with a TMK The Cayman SPC holds the equity interests with voting rights in the Japanese SPC (TMK or YK/KK) and is the 100% parent company of the domestic SPC and the Cayman SPC is owned in turn by a trust company for the benefit of the charitable trust. The trust company uses the trust pledge system to form a charitable trust with the shares it owns in the Cayman SPC and then concludes a contract that the residual property of the Cayman SPC, upon completion of the trust period, will be donated to a charitable body (charitable body designated the beneficiary interest holder). In this case, the trust company becomes both the trust settlor and trustee and by taking these steps a structure is created where there is no specific shareholder with voting rights in the Japanese SPC and so is bankruptcy remote. Cayman SPCs are used because there is no minimum capital requirement in the Caymans and it is thus both inexpensive and easy to establish an SPC plus there are tax advantages. c. Chukan Hojin (1) Legal Definition of Chukan Hojin There are two types of Chukan Hojin: limited liability Chukan Hojin and unlimited liability Chukan Hojin. The members of a limited liability Chukan Hojin have voting rights but as the members have no obligation to contribute funds (equivalent to paid-in capital in a KK). Thus the limited liability Chukan Hojin has the characteristic where the investor in the Chukan Hojin (equivalent to a shareholder in a KK) and the holder of the voting rights (member) are not necessarily the same. (2) Bankruptcy Remote Structure Using the

Chukan Hojin Bankruptcy remoteness from the originator is secured by having the equity interest that carries the voting rights of the SPC that owns the securitized asset acquired by the limited liability Chukan Hojin. The specific structures are as follows:

(3) Merits of the Chukan Hojin

|

|||

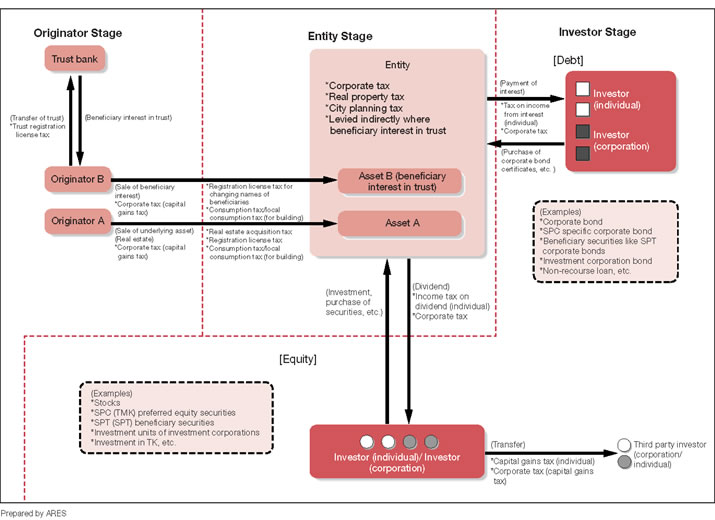

2. Tax Points 1) Double Taxation If the securitization vehicle is treated as a taxable entity it will recognize taxable income and corporation tax will be assessed. This will reduce the profits that are available to be distributed to investors and any distributed profits received by the investors will be taxed as income to the investors. From the perspective of the investor this “double taxation” is a poor result and if it may be avoided investment return will increase to the investor. There are two primary methods for avoiding double taxation: i. Use a securitization vehicle that is not taxed as a vehicle, i.e. a pass through entity, and ii. Develop a structure where even if the vehicle is a taxable body the profits distributed to investors can be recorded as deductible expenses i.e. a pay through entity. Figure 1-7 Outline of the Real Estate Securitization Tax System *Click the image, large size is available

2) Conduit Requirements Pass-through conduits include NKs, TKs and trusts while pay-through conduits include TMKs and TMSs under the Asset Monetization Law and investment corporations, investment trusts under the Investment Trust Law. The following is an overview of the requirements of the respective conduits. a. NKs under the Civil Code or Real Estate

Syndication Act b. TKs under the Commercial Code or Real

Estate Syndication Act As the business is conducted in the name of the operator the TK is not taxed and the investors share of the profit or loss is recorded as a deductible expense of the operator and so is a pass-through structure. To create real estate securitization vehicles, YKs or KKs are combined with TK contracts to create pass-through entities for investors. TKs are treated in the same manner under the Real Estate Syndication Act. c. Trusts However, under the investment trust system regulated in the Investment Trust Law that will be described later in more detail, a TMS that uses a trust as its structure is a taxable body for the purposes of corporation tax unless certain requirements are met and thus acts as a pay-through entity. d. TMKs and TMSs under the Asset Monetization

Law e. Investment Corporations and Investment

Trusts under the Investment Trust Law 3) KKs and YKs in Other Situations |

|||

3. Accounting Considerations 1) Requirements for Moving Assets Off Balance Sheet The guidelines for recognizing if a property has been successfully moved off balance sheet are detailed in the “Practical Guidelines on the Accounting of the Transferring Party in Real Estate Monetization Using TMKs” (prepared and issued by the Japanese Institute of Certified Public Accountants in July 2000). These Guidelines are generally referred to among practitioners as the “SPC 5% Rule” and “Practical Guidelines.” 2) Important Elements from the Practical Guidelines on Real Estate

Monetization a. The Practical Guidelines cover the asset monetization structure and not the asset management structure. In other words, it only applies to TMKs and equivalent vehicles (the SPVs) under the Asset Monetization Law. b. The Practical Guidelines are exclusively concerned with the accounting treatment of the transfer of real estate to TMKs and do not necessarily apply to the tax accounting for the transaction. Thus there are cases where the sale is not recognized for accounting purposes but capital gains are recognized for tax purposes. c. The Practical Guidelines designate the accounting treatment when the originator transfers existing real estate it owns to a TMK. Therefore, it is not applicable when a TMK acquires real estate from a third party. Hence it does not cover development securitizations where a TMK acquires newly developed real estate however the issue of consolidated or non-consolidated treatment does emerge with the company that is the investor in the TMK. d. The Practical Guidelines state that the sales treatment of real estate is the following for a true sale (page 10): “Moving the concerned real estate off the balance sheet is recognized when almost all of the risk and the economic value related to the transferred asset are transferred to another party” (risk and economic value approach). Conversely, the interpretation can arise that when the transfer off balance sheet is not recognized then the sale (transfer) of the real estate is not recognized and in this case it will be treated as a financing transaction secured by the asset. e. “Almost all of the risk and economic value has been transferred to another party'” is deemed to be achieved when the portion of risk borne by the originator of transactions is “generally within 5%.” “Generally” allows for a certain degree of latitude and discretion; however, caution is needed in the situations where this risk rises over time. f. When the originator continues to be involved in the real estate even after its has been transferred there is the possibility that it will be deemed that the economic risk and economic value have not been transferred to a third party. In the case of a sale and leaseback that is frequently seen in monetization, continual involvement is not recognized when the lease agreement is an operating lease transaction and the paid rents are market prices. g. When the contract allows for the originator to purchase the transferred asset at some point in the future, the sale of the real estate will not be recognized and it will be treated as a financial transaction. Further, if it is difficult to sell the subject real estate in the market to a third party in “as is” condition or other special conditions exist, a sale will not be recognized for accounting purposes. |

|||

|

|||