4. Real Estate Securitization Market Participants

One characteristic of real estate securitization is that it fuses the real estate business and finance but makes a clear distinction between the various functions and has created a further division of functions.

In response to this trend for clearer distinction between the functions there is a need for increasingly greater specialization or unbundling of the various services that is driven principally by the diversity of laws and ordinances that are relevant to each transaction and the differing structures utilized in each securitization project. Thus the greater division of roles now compared to earlier real estate transactions has led to an increasing number of participants in each transaction.

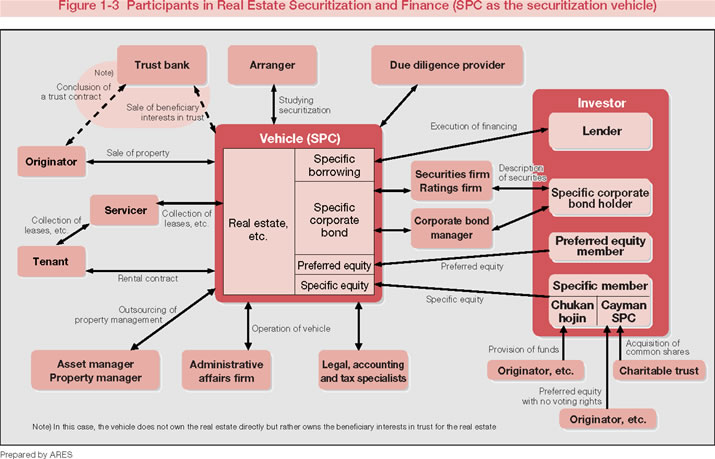

One other factor that has made real estate securitization difficult to understand for Japanese speakers is the frequent use of non-Japanese terminology. We have compiled an overview of the market participants, their roles in real estate securitization and finance aspects to real estate securitization to serve as an introduction and assist in the understanding the roles of participants (Figure 1-3).

Figure 1-3 Participants in Real Estate Securitization and Finance (SPC as the securitization vehicle)

*Click the image, large size is available

Note)

In this case, the vehicle does not own the real estate directly but rather owns the beneficiary interests in trust for the real estate

1) Originator

The term “Originator” commonly refers to the original owner of the real estate that is being securitized. The first step is that the real estate that is to be securitized is transferred from the originator to the securitization vehicle. Originators can be anyone who owns real estate and typically include developers, ordinary companies and financial institutions.

2) Investors

In exchange for receiving the investment returns from the securitized real estate, the investor accepts the economic risks of owning the real estate.

Investors can be subdivided into debt investors and equity investors and each investor group has specific risk-return characteristics they aim for when investing in real estate securitization products.

3) Lender

Lenders fall under the category of debt investor and are primarily financial institutions that provide non-recourse loans to securitization vehicles. Individual institutions may provide loans or a number of financial institutions may together provide the loan through a syndicated loan. Nonrecourse loans can be subdivided into various tranches that have varying rights with regard to receiving principal and interest, which are called senior and subordinated tranches.

4) Arranger

The arranger assumes overall responsibility for the overall structure of the real estate securitization and provides the knowledge and administrative functions needed to create the securitization framework and for implementing the securitization, which includes liaison between the originator, investors, lenders and other related parties. The arranger has to be able to accurately understand the needs of each party of the transaction as well as have the skill to coordinate the logistics of the securitization and specialist knowledge to negotiation effectively with lawyers, tax attorneys and accountants when necessary.

The arranger is responsible for supporting and coordinating with third party consultants and contractors for preparing due diligence reports, engineering reports etc. and advises in the selection of various professional service providers including accountants, lawyers, real estate appraisers, trust banks and securities firms. After the asset is in the securitization vehicle the arranger may select the underwriter for the sale of public securities, if applicable, as well as the financing counterpart who will provide the nonrecourse loan and finally provide advice when considering disposing of the real estate.

Generally, arrangers are securities firms, city banks, trust banks, other financial institutions, real estate companies and consultants.

5) Underwriter

Underwriters are most commonly securities firms. They underwrite the securities derived from real estate securitization, handle the public issuance of securities in the capital markets and also conduct investor surveys to determine how receptive investors will be to various products. Their primary responsibility to the investors is to ensure that the investors understand the concerned securitization products. There are cases where securities firms have acted both as arranger and underwriter.

6) Trust Banks

One of the most common real estate securitization structures in Japan involves the originator entrusting the real estate to a trust bank and then transferring the trust beneficiary interest to the securitization vehicle. Establishing the trust beneficiary interest enables the trust bank to apply its knowledge of the management, operation and sale of real estate assets to improving the performance of the securitization as well as reducing the real estate acquisition tax that is payable on the transfer of the asset.

The trust bank is a specialized institution that can handle a variety of functions for a real estate securitization; a trust bank can act as the arranger, lender, bond manager, asset custodian when the securitization vehicle issues corporate bonds and handle administrative duties.

7) Rating Companies

Ratings are a simple method of assessing the creditworthiness of the debt instruments issued by a securitization vehicle (corporate bonds, commercial paper, borrowings, etc.). An independent third party assesses the ability of the securitization structure to meet its principal and interest obligations, which are then made available to investors by the ratings agencies.

Obtaining a rating from a rating agency increases the transparency of the securitization structure and improves the marketability of the securities that are issued, thus the fund raising becomes easier.

8) Asset Manager

The asset manager specializes in the management and operation of the securitized real estate. The asset manager is responsible for developing the financial strategy of the asset, its purchase and sale at the end of the securitization period. The asset manager is also responsible for providing direction to the property manager in regard to attracting tenants and general property management policy, as well as supervising the property manager's performance managing and operating the property. The asset manager is ultimately responsible for the performance of the asset and has a fiduciary duty to maximize the value of the asset.

In situations where investors invest in an asset-management securitization, the asset manager is responsible for investing the funds invested by investors in real estate related assets and in such a case the asset manager may be referred to as the fund manager.

9) Property Manager

The property manager is responsible for the day-to-day management of the real estate asset and is focused on maximizing the earnings of the real estate asset. The property manager is usually a third party contractor chosen by the asset manager and contracted with the real estate owner or asset manager. The property manager's duties include tenant management (tenant attraction and leasing management) and building management work (maintenance). The property manager also provides detailed reports on its work to the client.

There are cases where the asset manager also acts as the property manager or building and facility management firms that manage other buildings locally provide these services under contract.

10) Servicer

The source of the cash flow generated by real estate is the rent paid by the tenant and the servicer is responsible for the collection and accounting of these monies. Generally in Japan a servicer is considered to be someone who collects and manages loans and other debts and is certified under the Debt Servicer Law; however, a broader definition is used here. Although the property manager often collects rents in real estate securitization, in certain cases the originator handles the collection of rents to maintain the tenant relationship that existed prior to the securitization.

11) Administrative Affairs Manager

The administrative affairs manager is responsible for the operation and maintenance of the securitization vehicle, including communication with investors at the behest of the directors of the securitization vehicle. This function is required outside of the securtization vehicle because the operations that a securitization vehicle may perform are very limited; this is to avoid additional bankruptcy risks such as liabilities connected with employees. In a case where an administrative affairs manager is required, the vehicle will contract with a third party to handle its administrative affairs.

12) Lawyer

The many participants in a real estate securitization transaction make it necessary to prepare many contracts to clearly define the relationship of each participant along with their respective responsibilities, duties and liabilities. This task is best handled by a lawyer. The lawyer also handles legal due diligence, specifically the lawyer prepares opinions on true sale, bankruptcy remoteness, validity of contracts, compatibility with related laws and other material legal aspects that can become vital issues with the structure at a later date.

13) Certified Public Accountant and Auditor

The real estate securitization vehicle ordinarily prepares a balance sheet, profit and loss statement, business report, profit distribution calculations or loss disposition calculations and incidental itemized statements at the end of every fiscal year. Not all vehicles are obligated to have audits conducted by auditors, but it is desirable to have an audit conducted by a certified public accounting firm in order to provide an additional level of protection to investors. The accounting office not only provides accounting services for the securitization vehicle but also provides advice on accounting issues the originator may face.

14) Tax Attorney and Tax Attorney Corporation

Certain securitization vehicles can deduct profit distributions as an expense to qualify for these tax advantages, thus reducing the tax liability of the securitization structure. Others may be eligible for reduced real estate acquisition taxes. However, many requirements must be satisfied to qualify for these tax advantages. These requirements are detailed and intricate and require the filing of many reports with the tax authorities that must reflect the individual circumstances of each securitization to ensure the tax benefits can be enjoyed. Therefore, the advice of tax attorneys is regularly sought and the attorneys are usually asked to submit tax opinions as well as supervise the filing of tax reports.

15) Due Diligence Vendors

Due diligence is the detailed examination of the real estate by a potential buyer and/or an investor considering investing in a real estate securitization. The process is used to accurately assess the investment value and risks of the real estate under investigation. Due diligence is ordinarily focused in three specific areas, studies on the physical condition of the property, legal studies and economic studies and are compiled into reports (engineering report, real estate appraisal, etc.) by construction firms, environmental study firms, real estate appraisers, judicial scriveners, land and building investigators, lawyers, consultants and other specialists. |